How much does the average American pay for healthcare every year? And, would enrolling with a direct primary care practice save Americans more money?

How much does the average American pay for healthcare every year? And, would enrolling with a direct primary care practice save Americans more money?

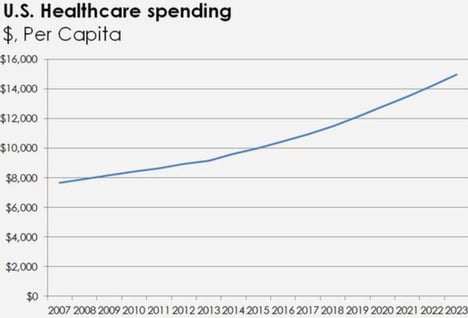

The Centers for Medicare and Medicaid Services (CMS) analyzes historical healthcare spending and provides projections for future healthcare spending. In its most recent report, the CMS details spending through 2012 and presents estimates for healthcare spending through 2023.

And, those estimates are alarming.

According to the CMS, the average American spent $9,596 on healthcare last year, up significantly from $7,700 in 2007. That means that Americans are increasingly under pressure to pay for their medical costs and unfortunately, the situation is only expected to worsen. Healthcare spending per person is expected to surpass $10,000 in 2018 and then march steadily higher to $14,944 in 2023.

For 2015-25, health spending is projected to grow at an average rate of 5.8% per year or 4.8% on a per capita basis.

Even if you're currently spending less per year on healthcare than the average American, your spending is likely to climb significantly as you get older and as new treatments become available. Since the increase in healthcare spending poses a risk to your financial security, it may make sense to think about alternative options that can save you money, such as becoming a member of a direct primary care.

Direct Primary Care

Direct primary care is an alternative primary care model that completely eliminates third party insurance and allows physicians and patients to directly contract for health care services.

Benefits to the patient vary by practice but they typically include longer appointments (45+ minutes of face-to-face time with the physician), all-day access to the physician, no waiting room times and basic tests at no additional charge. Direct primary care doctors tend to have a much lower patient volume, more convenient and flexible office hours, and they offer their personal cell telephone numbers in case of emergency, which is not an option in contemporary primary care practices.

However, the biggest benefit to the patient is cost.

How Direct Primary Care Saves Patients Money

Most direct primary care practices charge a membership rate of $100-150 per month for comprehensive primary care care, including office visits, minor procedures, blood draws, and other in-office services. There are no copays and no deductibles to meet in order to see your doctor.

Patients with high deductible health plans can financially benefit by enrolling with a direct primary care practice. Since standard health insurance can be expensive, many small business owners and individuals without coverage through their work participate in a high deductible health plan, which is often referred to as a "catastrophic" health plan.

High deductible health plans have much lower monthly premiums than standard insurance plans, but are intended to cover emergency care such as hospitalizations. They don't start to pay until a certain amount of money, called a deductible, has been met. Healthcare.gov states that, "For 2016, the IRS defines a high deductible health plan as any plan with a deductible of at least $1,300 for an individual or $2,600 for a family." High deductible plans can go even higher, up to the maximum out-of-pocket limit, which is $6,850 for an individual plan and $13,700 for a family plan.

Let's assume that a family of 4 buys the least expensive high deductible plan. Their insurance won't begin to pay anything until they have spent $13,700 on health care, after which point, the insurance will pay for covered medical expenses at 100%. If a family member needs to see a doctor for a minor issue, he/she can expect to pay the standard rate for each visit (anywhere from $100-300) until he/she reaches that out-of-pocket maximum.

Related Article: Direct Primary Care Eliminates Patient Wait Time

Rather than paying for doctor visits separately, another option for this family would be to enroll in a direct primary care practice. For an average cost of $100-$150 per month, the entire family would have unlimited access to a primary care physician, while maintaining a lower cost high deductible insurance plan for unexpected serious health crises.

Here's an example: Today's healthcare.gov price for a married couple in Florida is $10,000 per year for the highest deductible plan. The best plan available, which does have a $1,000 deductible and copay requirement, costs $20,000 per year. If this couple chooses the high deductible plan, and enrolls in a direct primary care practice at $1,800/ year, they will save approximately $8,200 per year, assuming no emergencies occur.

For someone with a current high deductible plan, enrolling with a direct primary care practice is an obvious certainty. For everyone else, it may make sense to crunch the numbers as open enrollment for health insurance approaches, and see if a change to a lower cost high deductible health plan along with a direct primary care membership makes sense.

Is direcet primary care right for you? The physicians at Total Access Medical are offering to meet with you for FREE to answer any questions you have.